Get to know your business structures!

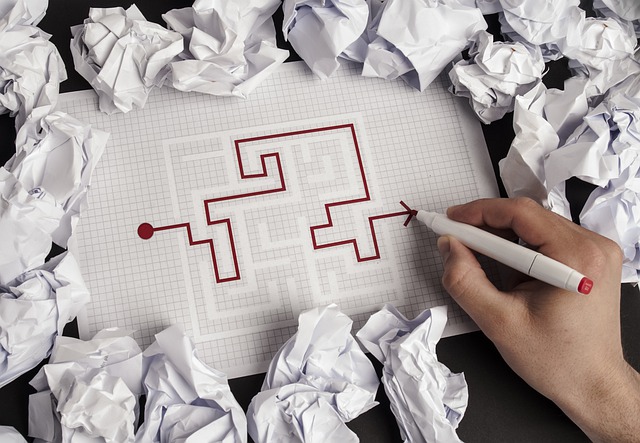

We’re going to give you a run down and introduction to the main structure types for businesses, so you’ve got the basics down pat.

This structure overview will explain what do they do, why we need them, and which one is the best for you.

Choosing the right structure for your business is really important. Each different structure type has their own tax and paperwork requirements.

The right structure can have some great advantages. They can help you be more tax effective and flexible and help you to protect your assets.

Now if you have a business, or are about to start one, then this is a good place to start. Every business will have/needs a structure. This helps your business to operate and differentiates between a person and a business (and this is very important to be tax effective).

This is one the most important steps when starting up a business regarding tax minimisation and flexibility. It impacts the amount of tax you pay and the amount of paperwork. So, if we get this sorted then you’re off to a great start! (Although, we do always recommend re-evaluating your structure type and effectiveness as your business evolves).

Now each structure has their own features, advantages and disadvantages.

[keep an eye out on our latest blogs for in depth explanations of each of these structures].

- Sole Trader

- Company

- Partnership

- Trust – Discretionary or Unit

SOLE TRADER

A sole trader is the most simple and cheapest structure a business can choose from. This is often where most businesses start as. Why? Because it’s cheap and easy and it gets them up and running quickly. It only requires the business owner to run it, and it’s easy to transition to the next step (or the next structure). The downside? Once you start to bring in the big $ it doesn’t become a very tax effective structure. Why? All the profits and revenue are associated with your personal tax file number, as you are the business as well. It also provides virtually no protection of your personal assets either.

A company or trust structure is generally the next stage. After a business is making a profit consistently they may have outgrown the sole trader structure. It’s here where it starts to get a little more complicated. It requires quite a bit more paperwork, and at this stage we definitely recommend getting some advice from a professional. So if that’s you, it might be time to give us a call.

COMPANY

A company structure is a separate legal entity, unlike a sole trader, where they are intertwined. If your profits are higher, it becomes a more tax effective structure to use, and also helps to protect your personal assets too.

TRUST

A trust structure requires a trustee, which can be either an individual or a company. A trust structure is a separate legal entity and is beneficial for protecting assets and providing tax flexibility. The main types of trusts are discretionary trusts and unit trusts. I know, we’re getting a little complicated here. These structures start to become quite expensive to set up, so it’s something that needs to be discussed to weigh up the costs and benefits to find out if it’s worth doing for your particular situation, and just which way to go about it.

PARTNERSHIP

A partnership is not associated with your personal TFN, and instead must have an ABN and TFN through which all of your business dealings go through. The control is shared across the partners (because as I’m sure you’ve worked out my now, a partnership structure requires more than one owner). The owners of the business are not deemed employees, as the business is not a separate entity to you, so in some partnerships you can also be personally liable for the business’s debts. This is where it is important to discuss the structure requirements and options with somebody who knows what they’re talking about, because you don’t want everything you’ve worked so hard to earn, taken out from under you. This structure is a step up from a sole trader and we are getting a little deeper into the paperwork too, however like a sole trader, partner’s receive their share of the income to them personally, for the majority of the time.

There are a lot of more different structure types out there, and many advantages and disadvantages to them all as well (as well as varying amounts of legal paperwork they require).

If the tax side of these structures still have you raising an eyebrow, you can get more info here. There you can find out what taxes your business needs to be registered for.

We’ll be going into more detail about these structures in following weeks, so stay tuned to learn more about the ins and outs of them!

If you have any questions about anything you’ve read, give us a call and we can talk you through it!