Home Office Expenses

Not many people know that when you work from home you can actually claim a lot back, sometimes on things you wouldn’t have even thought about like water usage, heating, cooling and even cleaning. I’m hoping today we will be able to better educate you on what you can and can’t claim and put some of that hard-earned money back in your pocket $.

So, what is the proper definition of home office expenses?

If you’re an employee who regularly works from home, you may be able to claim a deduction for expenses relating to that work. These are generally home office running expenses, and phone and internet expenses.

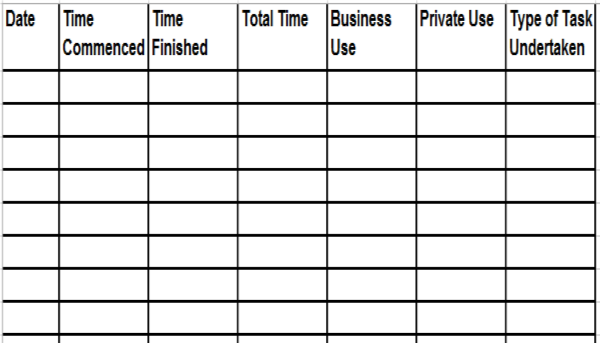

Just to make things a little more confusing and complicated there are many types of home office expenses, let’s talk about being an employee first. If you as an employee bring work home, work from home and have purchased anything from a desk to a chair to a filing cabinet you are eligible to claim those back. You MUST keep a 4-week diary to determine the business use and phone usage. Not many people would know this but you can even claim 52 cents per hour for any heating, cooling, lighting etc. that you use while working as long as you keep receipts and provide details so that we can gain the best tax advantage possible.

If your home is the place of business in either an owned home or a rented one you can also claim back tax. However, dependent on whether you are rent or own the home depends on what you can claim, I know we are getting even more complicated.

Let’s start with if you rent the home your working out of you can claim expenses according to floor area. You can claim your rent, insurance for business equipment, water usage, heating, lighting, cleaning and cooling as long as receipts and detailed explanations are provided. As an added bonus there are also NO CGT ISSUES!

Now what if we own the home we are working from, well again we can claim on expenses according to floor area with things such as building insurance, insurance for business equipment, water usage, council and water rates, loan interest, bank fees, borrowing expenses and body corporate fees. All of these can be claimable as long as the right receipts and detailed explanations are provided. On top of this, CGT on sale of the property will apply on pro-rata floor area basis.

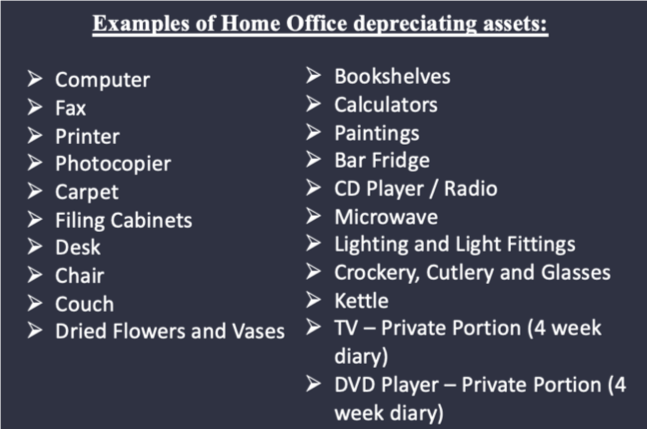

We have covered the expenses that you can potentially claim back but now here comes the additional part, the depreciation. Some examples of home office depreciating assets include:

There is just so much more I can cover when it comes to home office expenses but I have tried to keep it as simple as possible. As spoken about before, with the 4-week diary you all need to complete, we have gone ahead and developed one that you can use just to make your life a little easier. Here’s what it looks like;

If you would like a FREE downloadable home office expenses checklist you can access it here to make sure you claim all of the expenses you’re eligible for!

If you would like to delve further into what you can claim, the depreciation and so much more Adrian Hill has made a webinar for you all which will be posted on our YouTube page on November 27th, so please go check it out. If you have any further questions please don’t hesitate to give us a call or an email at the office we would love to hear from you, HAPPY SAVING!